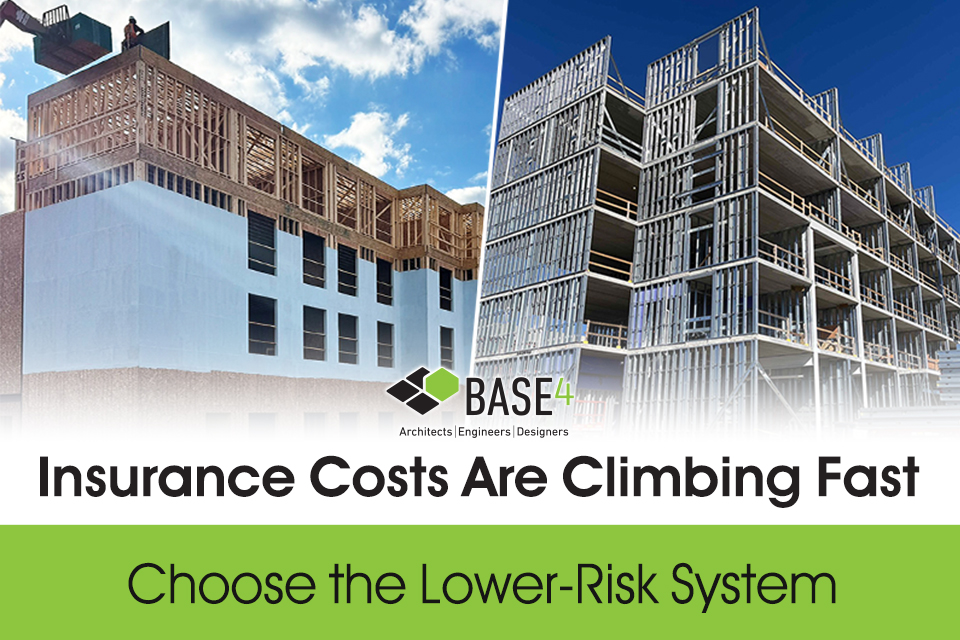

Insurance premiums jumped again this year, and developers are feeling it. But the most significant savings still come from one move: choosing a lower-risk building system.

Why Insurance Costs Are Spiking

Most developers expect higher premiums in wildfire or hurricane-prone regions.

But recent reports show something unexpected:

- The Midwest has seen the most property losses over the last two years, due to tornadoes and lightning strikes that heavily impact wood-framed construction.1

What This Means For Your Project

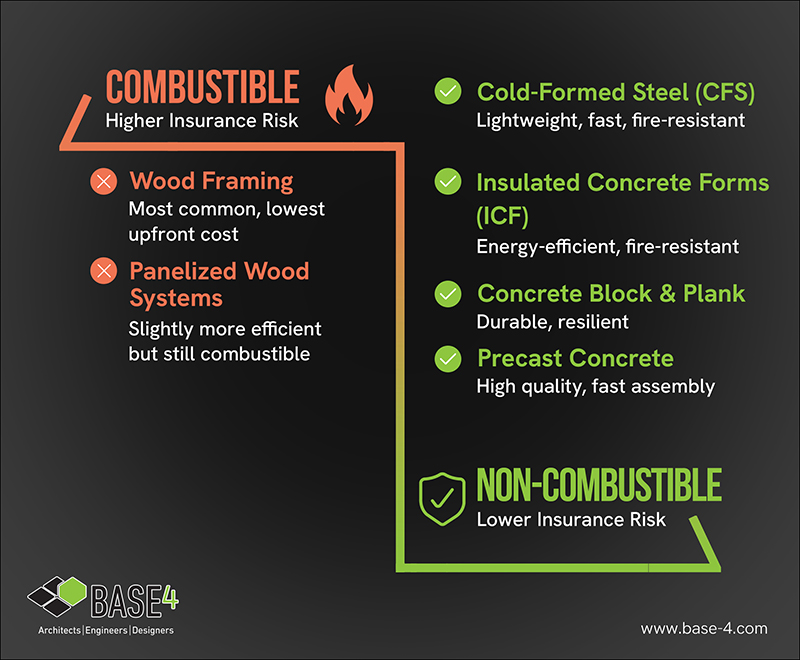

Material Choice = Insurance Cost

Builder’s-risk insurance is tied directly to risk, and structural materials play a big role.

Developers who switch to non-combustible framing see immediate insurance benefits—sometimes enough to close financial gaps in today’s challenging lending environment.

Quick Answers For Developers

What developers ask us most about insurance and materials

![]() Slightly higher build costs often lead to massive long-term savings.

Slightly higher build costs often lead to massive long-term savings. ![]()

Ready To Find Your Savings?

Even a slight change in the structure can lower your insurance burden. If you’d like to compare wood vs. non-combustible options for your project, we can help you evaluate the difference.

Thank you,

Blair Hildahl

BASE4 Principal

608.304.5228

BlairH@base-4.com

![]()