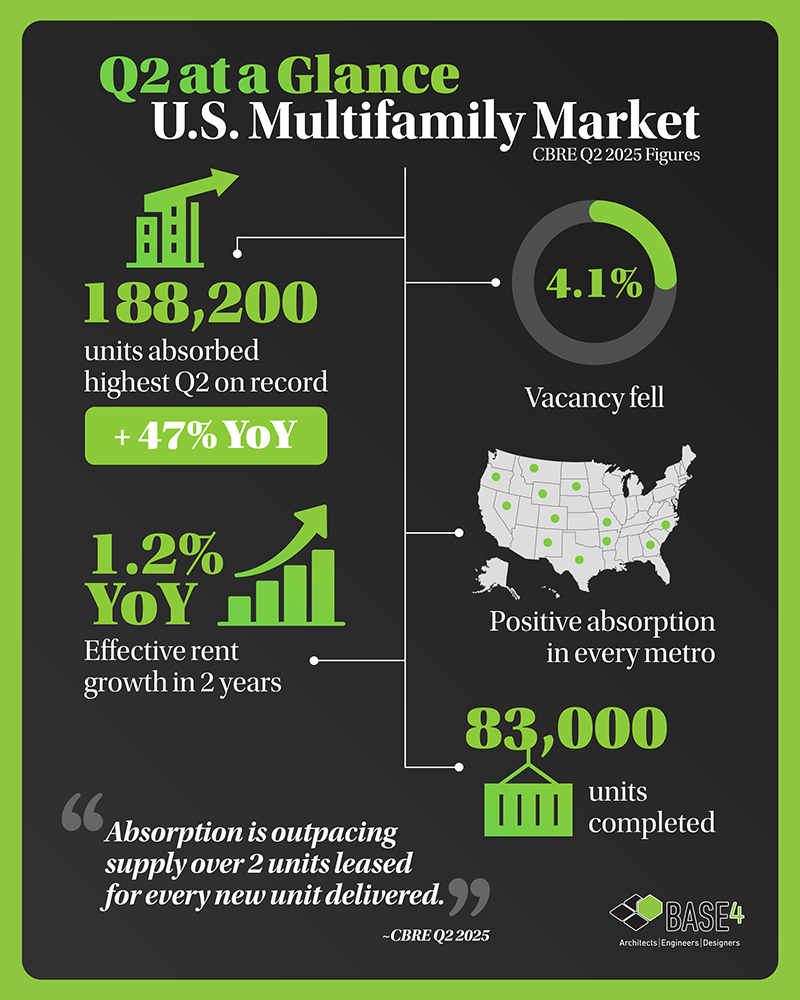

Q2 Demand Just Set a Multifamily Record.

What happens when two renters compete for every one new unit?

Net absorption hit record highs of 188,200 units in Q2, pushing vacancy down to 4.1% and ending a two-year rent growth slump with 1.2% YoY gains. 1

CBRE’s latest data signals a major shift in momentum—and developers are taking notice.

What’s Fueling the Shift?

-

Demand is outpacing new supply—by over 2:1

-

Pre-stabilized units are leasing faster than expected

-

Starts are slowing as financing tightens

Boise, ID: Just 516 new units delivered, yet occupancy climbed to 95.6%.2

What’s Next?

Rent growth is expected to pick up through mid-2026 as inventory tightens.

-

Investors are shifting to undersupplied markets like the Midwest.3

Build to Meet Today’s Demand — Faster

The multifamily market is moving fast. BASE4 helps developers:

-

Design smarter to match market absorption trends

-

Get approvals faster with complete, compliant plans

-

Cut build times using modular and prefab-ready designs

![]() Nationwide, renters are snapping up units twice as fast as they’re built.

Nationwide, renters are snapping up units twice as fast as they’re built. ![]()

~ CBRE Q2 2025 Multifamily Figures

Thank you,

Blair Hildahl

BASE4 Principal

608.304.5228

BlairH@base-4.com

![]()

Source: