As multifamily developers, it is crucial to recognize the value of smart upgrades for multifamily energy efficiency. Energy-efficient projects are in high demand and tend to have a higher market value than their less efficient counterparts. Energy-efficient multifamily projects are now eligible for an expanded tax credit. Read on.

Energy-efficient projects are designed and built to minimize energy consumption while maximizing performance. They often feature insulation, energy-efficient appliances, advanced HVAC systems, and renewable energy sources like solar panels, among other key elements.

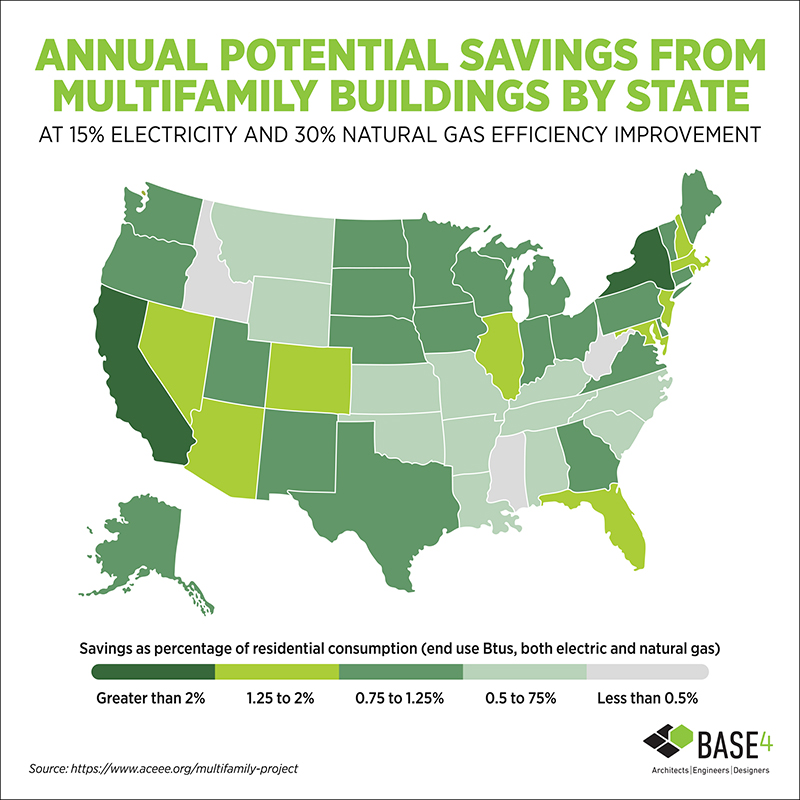

According to the American Council for an Energy-Efficient Economy (ACEEE), a comprehensive, strategic approach to energy management can improve the energy efficiency of U.S. multifamily properties by 15-30% and save $3.4 billion in utility costs.

Did you know: The Internal Revenue Service released new guidance for residential projects using the Section 45L tax credit for energy-efficient new construction. Properties obtaining this credit must meet Energy Star or Zero Energy Ready Home standards.1

The Inflation Reduction Act contains $500 billion in new spending and tax breaks that aim to boost clean energy. The Inflation Reduction Act of 2022 (IRA), signed into law on August 16, 2022, directs new federal spending toward reducing carbon emissions, lowering healthcare costs, funding the Internal Revenue Service, and improving taxpayer compliance. Regarding multifamily buildings, it states the following:

- MULTI-FAMILY HOME REQUIREMENTS: A dwelling unit meets the requirements of this paragraph if— ‘‘(A) such dwelling unit meets the most recent Energy Star Multifamily New Construction National Program Requirements (as in effect on either January 1, 2023, or January 1 of three calendar years prior to the date the dwelling was acquired, whichever is later), and ‘‘(B) such dwelling unit meets the most recent Energy Star Multifamily New Construction Regional Program Requirements applicable to the location of such dwelling unit (as in effect on either January 1, 2023 or January 1 of three calendar years prior to the date the dwelling was acquired, whichever is later).’’

These tax credits can help lower the cost of energy-efficient home upgrades by up to 30%.

- AMOUNT OFREBATE: For multifamily building owners and aggregators carrying out energy efficiency upgrades of multifamily buildings— (i) in the case of a retrofit that achieves modeled energy system savings of not less than 20 percent but less than 35 percent, $2,000 per dwelling unit, with a maximum of $200,000 per multifamily building; (ii) in the case of a retrofit that achieves modeled energy system savings of not less than 35 percent, $4,000 per dwelling unit, with a maximum of $400,000 per multifamily building; or (iii) for measured energy savings, in the case of a multifamily building or portfolio of multifamily buildings that achieve energy savings of not less than 15 percent— (I) a payment rate per kilowatt hour saved, or kilowatt hour-equivalent saved, equal to $2,000 for a 20 percent reduction of energy use per dwelling unit for the average multifamily building in the State; or (II) 50 percent of the project cost.

BASE4 Is Here To Help!

We recognize the importance of staying up-to-date with the latest industry news and trends. Having a knowledgeable team available to address any questions you may have is vital to harnessing your energy-saving ideas for your projects. Our team members are experts in design, having design experience in every state—ensuring quality and speed-to-market. We are architects & engineers rethinking the way buildings get built!

BASE4: The GO-TO Firm for Optimal Design

We know we are in volatile times, where supply chain issues…

The BASE4 team has worked around the globe, providing a wide range of expertise in quality standards, specifications, and international best practices for design. We at BASE4 believe in a PRODUCT mindset—bringing standardization and manufacturing principles to an outdated system.

Thank you,

Blair Hildahl

BASE4 Principal

608.304.5228

BlairH@base-4.com

![]()

Source:

1. https://www.multifamilydive.com/news/energy-efficient-multifamily-green-sustainable-tax-credit/695518/