The demand for new housing products right now is strong, but aside from traditional financing challenges, there’s a factor stopping developers—and that is rising construction costs. As a developer, you need to take advantage of every opportunity to make a project profitable—LIHTC might be that opportunity. Read on!

LIHTC stands for Low Income Housing Tax Credits. It provides a tax incentive to construct or rehabilitate affordable rental housing for low-income households. It’s a tax incentive program put out by the U.S Department of Internal Revenue Service or IRS to incentivize developers to build housing for lower-income families.

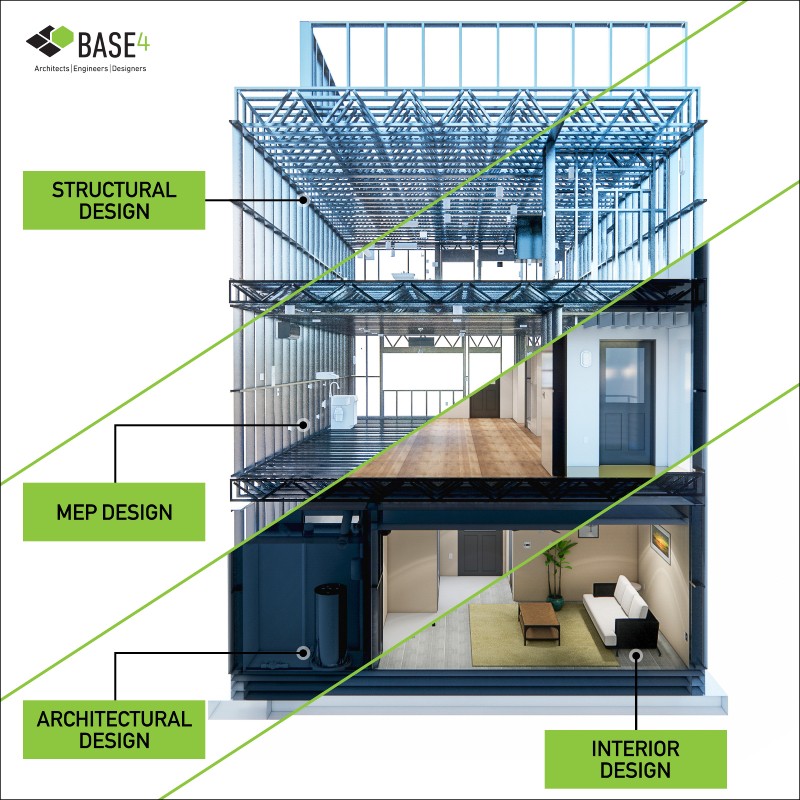

A LIHTC design proposal, as a HUD program, will have VERY SPECIFIC design requirements, including minimum unit mix, minimum unit sizes, and other submission processes, all of which vary from state to state.

![]()

The current administration is proposing to invest an additional $55 billion in tax credits, enabling the creation of tens of thousands more units per year.![]()

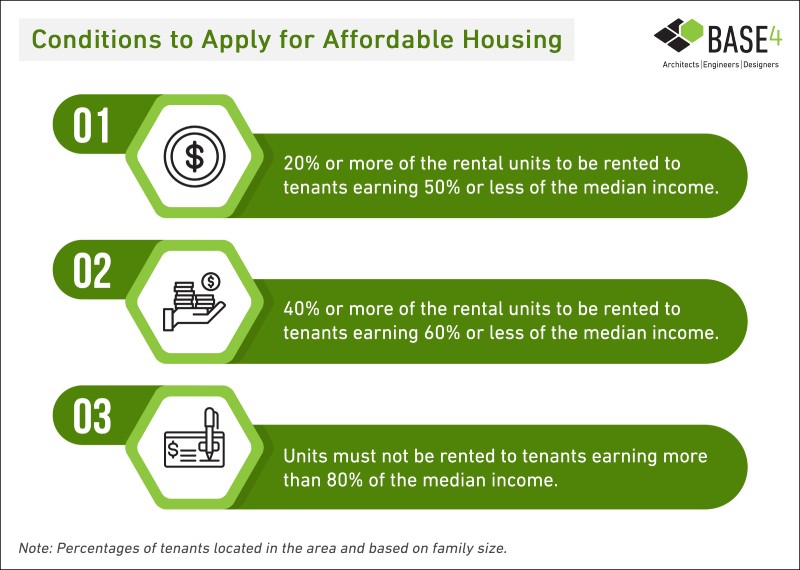

A wide variety of properties can be eligible for the Low-Income Housing Tax Credit. Still, there are more developers competing for credits than there are credits, as they are allocated based on state population. To qualify for the LIHTC, a project must meet one of the following conditions:

Benefits of LIHTC

- Under the program, state housing agencies issue credit allocations to developers who then sell the credits to investors. Investors receive a dollar-for-dollar reduction in their federal tax liability over 10-years, and developers invest the equity raised to build or acquire apartments.

Developers need a trusted and experienced design partner to assist with Affordable Housing projects! You need a design partner who understands how to create an efficient and high-quality living space with affordable construction options using industrialized construction methods. BASE4 is here to help!

Check out STONEPILEllc—The Online Construction College, the only institution of higher education dedicated 100% to construction innovation and education.

Thank you,

Blair Hildahl

BASE4 Principal

608.304.5228

BlairH@base-4.com

![]()

Source:

1. https://www.investopedia.com/terms/l/long-income-housing-tax-credit.asp

2. https://www.nmhc.org/advocacy/issue-fact-sheet/low-income-housing-tax-credit-fact-sheet/

3. https://www.novoco.com/resource-centers/affordable-housing-tax-credits/lihtc-basics/about-lihtc